A BP Oil Exec's Husband Has Been Found Guilty Of Insider Trading By Eavesdropping On Her Calls. Meanwhile, Members Of US Congress Continue To Make Millions And Millions On Trades They Have Direct Influence Over, And Their Own Insider Info, While Policing Themselves.

USA Today - The husband of a former BP executive has pleaded guilty to securities fraud after allegedly listening in on his wife's work conversations, federal officials say.

Tyler Loudon, 42, of Houston, made $1.7 million in illegal profits from the purchase and sale of stock shares, according to the news release from the U.S. Attorney's Office of the Southern District of Texas.

According to the U.S. Securities and Exchange Commission, Loudon's wife was an associate manager in mergers and acquisitions at BP who worked on the company's deal to acquire TravelCenters of America Inc., a full-service truck stop and travel center company headquartered in Ohio.

The SEC alleges that Loudon "overheard several of his wife's work-related conversations about the merger" while she was working remotely. Without his wife's knowledge, Loudon purchased over 46,000 shares of TravelCenters stock before the merger was announced in February 2023.

As a result of the announcement, the SEC said, TravelCenters stock rose nearly 71% and Loudon allegedly sold all of his shares for a profit of $1.76 million.

“We allege that Mr. Loudon took advantage of his remote working conditions and his wife’s trust to profit from information he knew was confidential,” said Eric Werner, regional director of the SEC’s Fort Worth regional office. “The SEC remains committed to prosecuting such malfeasance.”

According to U.S. Attorney Alamdar S. Hamdani, of the Southern District of Texas, Loudon agreed to forfeit the money as part of his plea agreement.

U.S. District Judge Sim Lake accepted the plea and has set sentencing for May 17. At that time, Loudon faces up to five years in federal prison and a possible $250,000 maximum fine, according to the U.S. Attorney's Office.

Somebody, please make this make sense to me.

I'm begging you.

This fuckin guy Tyler Loudon gets stuck in the house with his wife for two years thanks to the morons who run this country shutting the entire place down and locking us in our homes, and can't help but overhear her business calls all day long. She works for BP and is pretty high up so she's dealing with mergers and acquisitions.

BP is going hard to acquire Travelcenters of America gas station highway rest stops.

He figures, what the fuck? I see all these politicians raking it in on options trades they are definitely privy to information far ahead of time vs. the public, why can't I wet my beak a little on this? And he buys up some Travelcenters of America stock.

Now he's facing 5 years in jail?

Are you fucking kidding me?

It's not ok for Blue Horseshoe to love Anacott Steel, but it's perfectly fine for United State Senators and Representatives, who write bills and pass legislature all day to let's say write a giant infrastructure bill, buy up stock in one of the giant construction or steel companies bidding it out that they know it's going to go to, then announce the bill and pass it, and make fucking bank off the margin when the stock price jumps? Because mopes like you and I get in too late and drive it up?

Or even worse, they buy a call or put on a company they know is about to rake it in or take a bath thanks to a signed or cancelled government contract, or law passing, or real estate transaction they all have direct knowledge of.

No joke, it's actually a fact that so long as "a trade is reported within 45 days, there’s no law preventing members of the House or Senate from trading stocks, even if the bills they pass or committees they sit on could influence a company’s stock price."

Back in 2012, President Barack Obama signed the "STOCK Act", banning members of Congress from trading with nonpublic information, meaning details they glean in their work that are not available to the general public…

Yet Congressmen and women still trade as much as their hearts desire.

The twitter account Unusual Whales has been all over this in recent years. Pointing out one of the most egregious cases as of late- the Silicon Valley Banking collapse.

He pointed ABC News to the collapse of Silicon Valley Bank (SVB) and the regional banking crisis. He tracked trades showing several members of Congress, who sit on the House and Senate committees that regulate the financial industry, who sold SVB and other bank stocks before they experienced their sharpest decline.

“I can't know the intent, if that was what they were aiming to do,” he told ABC News. “But many of the members who were trading banking stocks during that time performed very, very well.”

Theoretically, congressional members can do as they literally did with SVB, or they could sit on say the Armed Services Committee and legally trade in the stock of defense contractors that receive sizable government contracts.

UNUSUAL WHALES Congressional Trading Report for 2023-

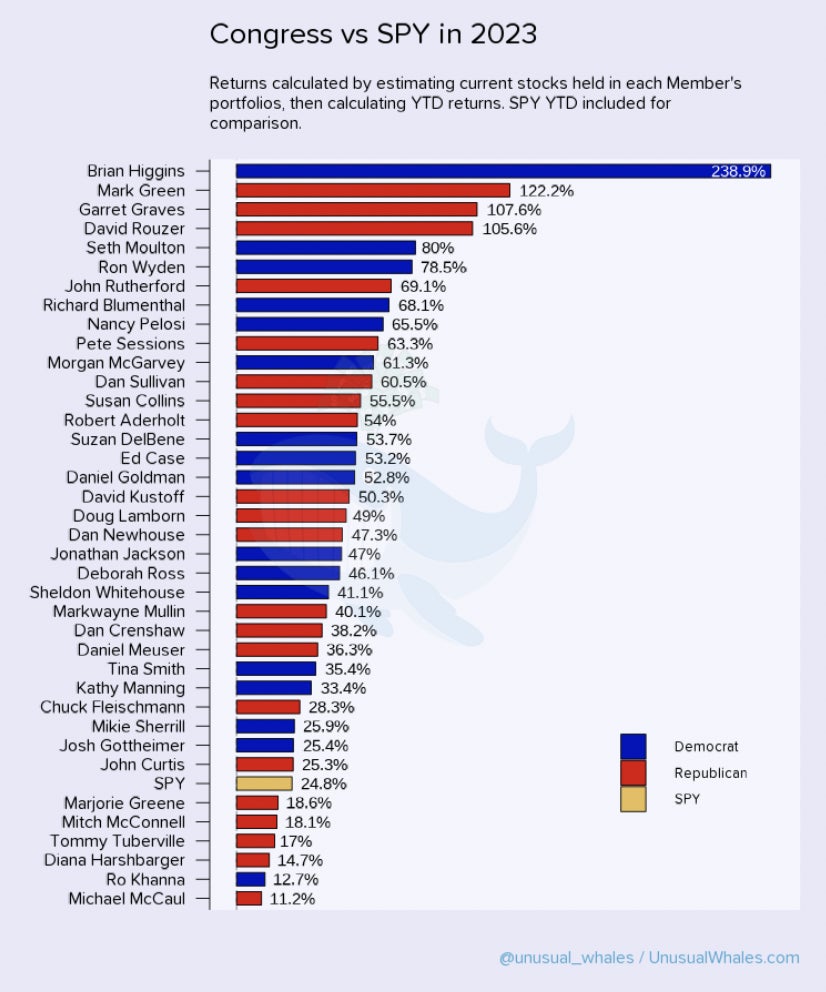

- Congress beat the market, once again. Of 100 trading members, 33% beat SPY with their portfolios.

- Democrats beat their Republican colleagues by a massive margin.

- Members are once again trading options, after not trading them in 2022.

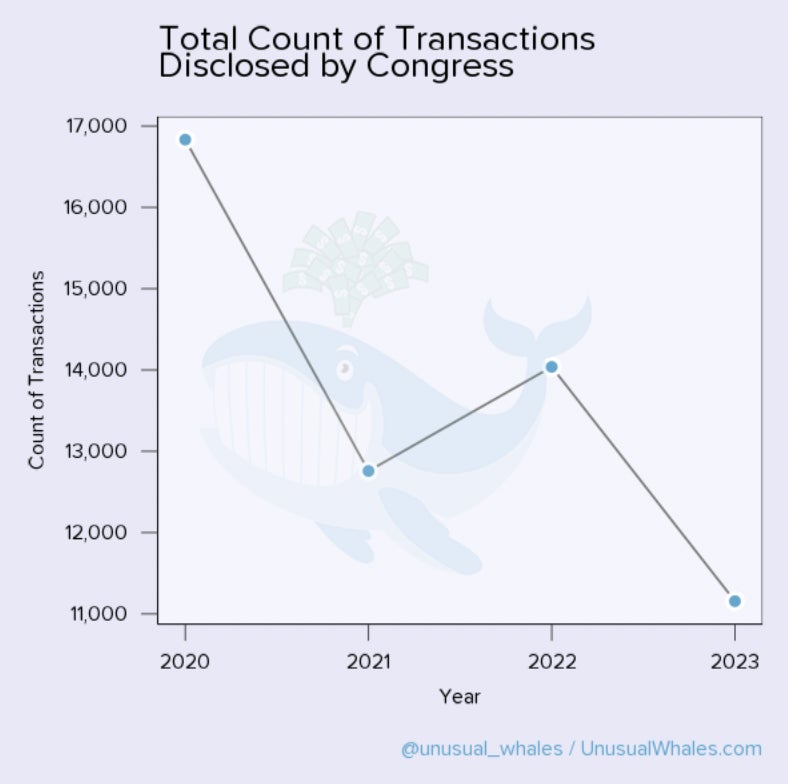

- The overall number of transactions by Congress is down. They are also reducing time to disclosure, as well as using the note feature, because people now watch them vigorously.

- There were many unusual trades and conflicts

- If you are a member of Congress or aide reading this report, are embarrassed or want to work with us or fight for market transparency, we can be reached at congress@unusualwhales.com

Annual reviews of the trades of 535 members of the House and Senate, compiled by the Unusual Whales account, have found lawmakers' stock portfolios consistently beat the S&P 500.

Sadly, this shit has been going on forever. This 60 Minutes bombshell piece is actually what some believe what prompted President Obama to sign the STOCK Act the following year.

House Speaker Nancy Pelosi, a multimillionaire and Wall Street legend, recently defended congressional stock trading, asserting the right of lawmakers to cash in on the very industries they oversee. “This is a free market, and people—we are a free-market economy,” Pelosi told reporters at a press conference last month. “They should be able to participate in that.”

(LOLz)

The STOCK Act is also the reason members of Congress are required to publicly disclose stock trades made by themselves, their spouses, or dependent children, within 45 days. But key components of the law were gutted in 2013, and, as a recent Business Insider investigation revealed, at least 54 members failed to comply with the STOCK Act last year. No member of Congress has ever been prosecuted for insider trading under the law.

I guess the good news, according to Unusual Whales, is that we're now on the down swing of things? Heading into an election year, and with lots of eyeballs on them now, politicians have curbed their trading frenzy. At least somewhat it appears.

And I don't think anything will compare to brazenness during peak covid era craziness.

Market Watch - Congress resembled a Wall Street trading desk last year, with lawmakers making an estimated total of $355 million worth of stock trades, buying and selling shares of companies based in the U.S. and around the world.

At least 113 lawmakers have disclosed stock transactions that were made in 2021 by themselves or family members, according to a Capitol Trades analysis of disclosures and MarketWatch reporting. U.S. lawmakers bought an estimated $180 million worth of stock last year and sold $175 million.

The trading action taking place in both the House and the Senate comes as some lawmakers push for a ban on congressional buying and selling of individual stocks. Stock trading is a bipartisan activity in Washington, widely conducted by both Democrats and Republicans, the disclosures show. Congress as a whole tended to be slightly bullish last year with more buys than sells as the S&P 500 SPX, 0.15% soared and returned 28.4%. Republicans traded a larger dollar amount overall — an estimated $201 million vs. Democrats’ $154 million.

So who were the biggest traders? The table below, based on a Capitol Trades analysis, shows the 41 members of Congress who made stock buys or sells in 2021 with an estimated value of at least $500,000 — or had family members who made such trades.

But good news guys, two congressmen went rogue and introduced a bill to effectively BAN all trading and investing by members of the Federal Government back in September of last year…

Senate.Gov - Sens. Ossoff and Mark Kelly (D-AZ) today introduced the Ban Congressional Stock Trading Act, which will require all members of Congress, their spouses, and dependent children to place their stocks into a blind trust or divest the holding — ensuring they cannot use inside information to influence their stock trades and make a profit.

This is an external link this policy, with 86% saying they back the measure, including 88% of Democrats, 87% of Republicans, and 81% of Independents.

“Members of Congress should not be playing the stock market while we make Federal policy and have extraordinary access to confidential information,” Sen. Ossoff said.

“Elected officials don’t just make policy; they also have access to valuable information that shapes different industries and the entire economy. Members of Congress should be focused on representing their constituents, not their stock portfolios,” Sen. Kelly said. “I’m reintroducing this legislation with Sen. Ossoff to prevent corrupt insider trading and make Washington work better for Arizonans.”

The bad news? It's still sitting on the floor and will most likely rot to death and expire because expecting these fuckheads to have one ounce of integrity, and pass something that requires having any character or ethics is laughable. It would be like asking a fox to guard the henhouse.

My younger sister works for a private equity firm and had to sign all these contracts stating she nor none of her family would ever buy or sell stock based on knowledge she has or companies her company works with. Basically, the legal equivalent of tying your own noose should the sheriff need to come looking for you.

Yet not only can congressmen trade, but they can have their family members, and in Nancy's case, her husband invest with free reign?

In 2022, the NY Times actually did some pretty good investigative journalism (remember when that was a thing?) and dug up information tying 97 members of congress to stock trades they legitimately had direct influence on by sitting on congressional committees related to them.

NY Times - At least 97 current members of Congress bought or sold stock, bonds or other financial assets that intersected with their congressional work or reported similar transactions by their spouse or a dependent child, an analysis by The New York Times has found.

The trading patterns uncovered by the Times analysis underscore longstanding concerns about the potential for conflicts of interest or use of inside information by members of Congress, government ethics experts say.

Times reporters analyzed transactions between 2019 and 2021 using a database of members’ financial filings called Capitol Trades created by 2iQ Research. They matched the trades against relevant committee assignments and the dates of hearings and congressional investigations.

When contacted, many of the lawmakers said the trades they reported had been carried out independently by a spouse or a broker with no input from them. Some have since sold all their stocks or moved them into blind trusts. Two said the trades were accidental.

"No, no, no, that wasn't us guys… it was my silly wife. She's always dumping money into our J.T. Marlin account and investing in defense contractors. She just got lucky. That's all. Nothing to see here."

Or even better, "oops, it was an accident."

Just straight-up spitting in the face, and an insult to We The People's intelligence.

Or lack thereof for continuing to put up with this all.

#FreeTylerLoudon

P.S. - Nate and KFC continue to be the only people in the company with the balls to have me on their shows. I've been incredibly outspoken about all of this for as long as I can remember. Cons and his crew discussed all this on their show this week, didn't have me on to get my thoughts, but did ask me on twitter after.